Blockchain M&A: Are We Headed Towards Mass Consolidation?

Every industry experiences waves of consolidation. Whether it be in financial services, technology or industrials, M&A is often necessary to drive innovation and create greater market efficiency. Given the sheer number of blockchain and cryptocurrency projects operating today, consolidation is inevitable and we’re already beginning to see the early signs.

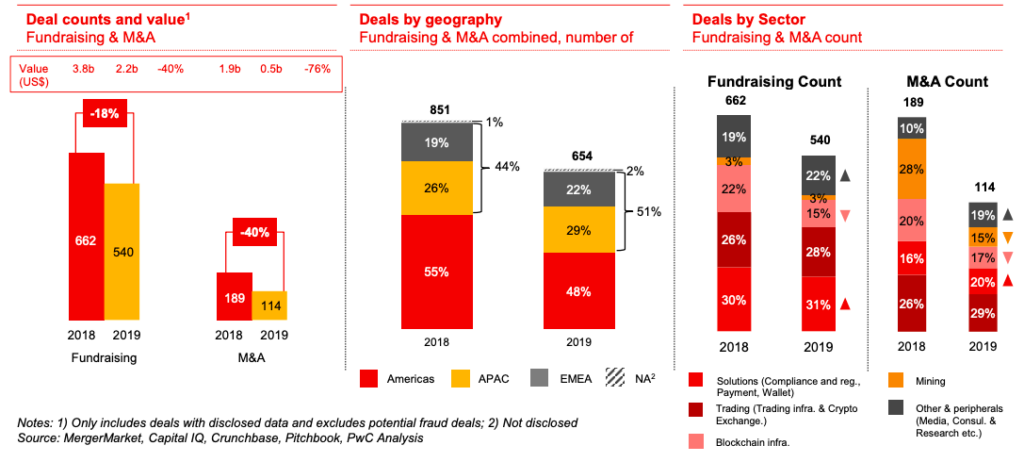

In April, PwC released its second Global Crypto M&A and Fundraising Report. The report noted that following a year of relatively steady deal activity and fundraising, the sector experienced a sharp drop in both – a 40% drop in deal volume and a 76% drop in deal value in 2019 over 2018.

And there is unlikely to be a recovery this year given the toll that Coronavirus is likely to take on the world’s economies. However, the report noted that as a result of the virus, there may be further consolidation fueled by the sell-off of smaller companies to larger companies that are better suited to weather the likely economic headwinds. PwC expects to especially see larger key players acquire companies that offer “ancillary services”, such as “crypto media, compliance, research”.

According to the report, APAC and EMEA saw an increase in deal volume and fundraising from 2018 to 2019 compared to the Americas, which experienced a drop. This trend is expected to continue. As the industry continues to mature and further institutionalize, we will see a shift from investments into blockchain infrastructure projects into investments into crypto exchanges and solutions-based services – particularly into compliance and regulatory solutions. The report also predicted that we should see “further consolidation in the industry with some of the larger well funded or profitable firms buying some of the smaller players in the market”.

What sorts of M&A deals DID occur in 2019? Nine out of 10 deals came from crypto businesses making strategic acquisitions. with the biggest one being cryptocurrency exchange Kraken’s $100 million acquisition of trading infrastructure company Crypto Facilities. However, 2020 has seen one of the biggest deals in crypto to date – Binance’s $400 million acquisition of CoinMarketCap.

As for fundraising, traditional VCs, incubators and family offices will continue to be the single largest source of funding for crypto projects, according to PwC. But we are also likely to see a rise in funding from established corporations.

You should expect to begin seeing much more deal flow and investments into crypto and blockchain companies, but more likely towards the end of the year and into 2021. Deal sizes will likely vary given the variety of projects in the space – ranging from smaller projects providing very useful ancillary services while larger and more established companies have grown tremendously since 2017 and may consider a sale or a post-seed round investment. Although the deal volume was much greater in 2018 and 2019 compared to 2020, we are only in the nascent stage of a still relatively new industry – which means, this is only the beginning and we can expect to see much more activity over the next several years and beyond.